om een gepersonaliseerde navigatie te krijgen.

om een gepersonaliseerde navigatie te krijgen.

Forum

expand navigation

Forum

expand navigation

- Alle onderwerpen als nieuw markeren

- Onderwerp als gelezen markeren

- Dit onderwerp naar boven laten zweven

- Bladwijzer

- Abonneren

- Dempen

- Printervriendelijke pagina

Entering a purchase invoice - reverse VAT, services from another EU country?

- Als nieuw markeren

- Als bladwijzer markeren

- Abonneren

- Dempen

- Markeren

- Afdrukken

- Ongepaste inhoud melden

Hi,

This is a very basic question, but I couldn't find an answer in English (or in Dutch with my limited skills).

In short -

- - I have a "VAT reverse charged" purchase invoice for services from Germany. How do I enter it correctly in Visma eAccounting?

- - Should I eventually pay VAT (to the Dutch tax office) for such purchases? If so, do I simply select the VAT rate based on Dutch rules, despite the service being rendered from abroad?

For the long version -- I first entered the invoice like so:

The corresponding accounting entries look like this:

I only realized this might be a problem when I tried to generate Q2's VAT report in Visma and it got rejected by the Belastingdienst.

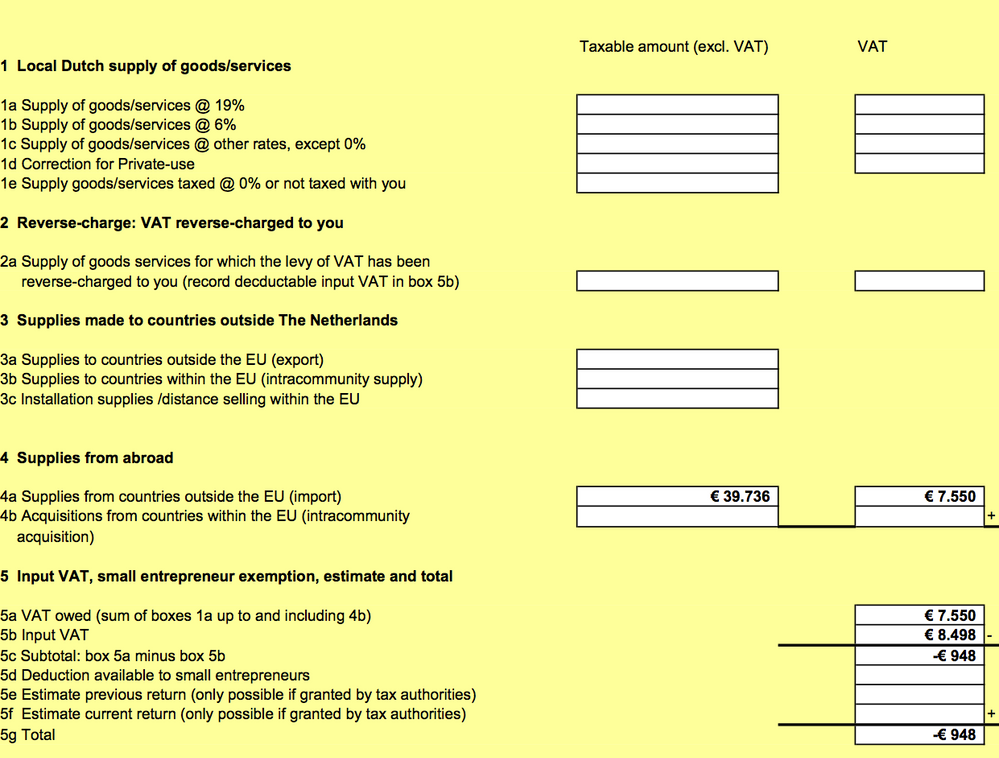

The generated & rejected report looks like this:

After the automatic rejection, I tried to file the VAT report manually on the Belastingdienst's website, and then realised that the problem must be with item 5b, "Voorbelasting", i.e. input tax from purchases I've already made & where I've paid VAT to the supplier. I haven't made any, so I think this row should be zero, but Visma instead calculated here the unpaid VAT from that purchase invoice, via account "1652 - Btw inkoop binnen EU (voorbel.)". I'm guessing that account was selected because I used VAT code "X (21%)" when filing the invoice.

Does this make sense, or am I completely on the wrong track? What would be the correct VAT code and account(s) to use here?

- Als nieuw markeren

- Als bladwijzer markeren

- Abonneren

- Dempen

- Markeren

- Afdrukken

- Ongepaste inhoud melden

@Anonymous thank you for such a detailed explanation. You are definitely helping many of entrepreneurs like me. So all in all, this means that what you did since the very beggining was fully correct , right?

and that basically the vat return report was rejected when doing it with Visma software just due to another factor but not to the booking itself that you did, right?

- Als nieuw markeren

- Als bladwijzer markeren

- Abonneren

- Dempen

- Markeren

- Afdrukken

- Ongepaste inhoud melden

Dear Peter,

It seems like the booking is correct according to the VAT-working of eAccounting.

See link to the Helpcenter of eAccounting below:

About sending and rejecting the vat-report by Belastingdienst can be caused by several items.

Please contact our support department of eAccounting by telephone: 020- 26 26 926.

Thank you in advance.

Remko/Supportspecialist eAccounting

Geef aub een "kudo" als je denkt dat het antwoord nuttig was en klik op "als

oplossing accepteren" als je vraag hiermee beantwoord is. Dit helpt anderen in de Community!

- Als nieuw markeren

- Als bladwijzer markeren

- Abonneren

- Dempen

- Markeren

- Afdrukken

- Ongepaste inhoud melden

Hi Remko,

Thanks for the response. But are the VAT code I chose and the generated VAT report themselves correct, since I haven't payed any VAT yet?

If I understood the VAT report correctly, "5b. Voorbelasting" should contain the amount of VAT I've already paid (by making purchases where VAT is included in the final price), and this should be zero?

- Als nieuw markeren

- Als bladwijzer markeren

- Abonneren

- Dempen

- Markeren

- Afdrukken

- Ongepaste inhoud melden

Hereby our friendly request to contact us by telephone so we can explain the VAT working of eAccounting in detail for you. Thank you in advance.

Remko/Supportspecialist eAccounting

Geef aub een "kudo" als je denkt dat het antwoord nuttig was en klik op "als

oplossing accepteren" als je vraag hiermee beantwoord is. Dit helpt anderen in de Community!

- Als nieuw markeren

- Als bladwijzer markeren

- Abonneren

- Dempen

- Markeren

- Afdrukken

- Ongepaste inhoud melden

Ok, for the benefit of anyone digging up this thread in the future -- I managed to solve the problem mostly on my own, and the the initial entries & VAT report in my OP were actually correct.

In a nutshell: even though the heading for field 5B in the VAT declaration form - "voorbelasting" - literally means "pretax" (input tax), i.e. tax payments that you have already made, in the case of intra-EU reverse VAT, you need to include here the theoretical VAT amounts that you have not paid. Both amounts are then deducted from your VAT debt.

Although the Visma staff I spoke to were helpful in pointing out the VAT code mapping table at the bottom of this post, they couldn't translate all of the terminology to English, nor (perhaps wouldn't, which is sort understandable, since this concerns more accounting than accounting software, although I assumed my OP had made the question clear) answer the actual question in this topic.

---------

The vital nugget of information is found on the tax office's website, in Dutch only:

Als u goederen uit andere EU-landen afneemt, brengt de leverancier u meestal 0% btw in rekening. U moet dan als afnemer Nederlandse btw betalen. Neemt u diensten af uit een ander EU-land, dan wordt de btw vaak naar u als afnemer verlegd. U berekent de btw in beide gevallen zelf en geeft deze aan in uw btw-aangifte. Die btw kunt u ook als voorbelasting aftrekken, voor zover u de goederen of diensten gebruikt voor belaste omzet.

Or, with the help of a certain well known machine translator:

If you purchase goods from other EU countries, the supplier usually charges you 0% VAT. As a buyer, you must then pay Dutch VAT. If you purchase services from another EU country, the VAT is often transferred to you as a buyer. In both cases you calculate the VAT yourself and state it in your VAT return. You can also deduct this VAT as input tax, insofar as you use the goods or services for taxable turnover.

IIRC, the contextual help for this field in the tax office's online VAT declaration tool doesn't mention anything about the field's dual purpose either.

Luckily, mffa.nl kindly provides an English translation of the Dutch VAT declaration form (direct link to the .PDF😞

Based on that document and poking around the tax office's site with an online translator, one can deduce a bunch of useful Dutch terminology. Apparently the Dutch term for "reverse-charged VAT" is "BTW verlegd" (literally "shifted" or "diverted", I guess), which appears in a lot of places in the VAT report & ledger accounts.

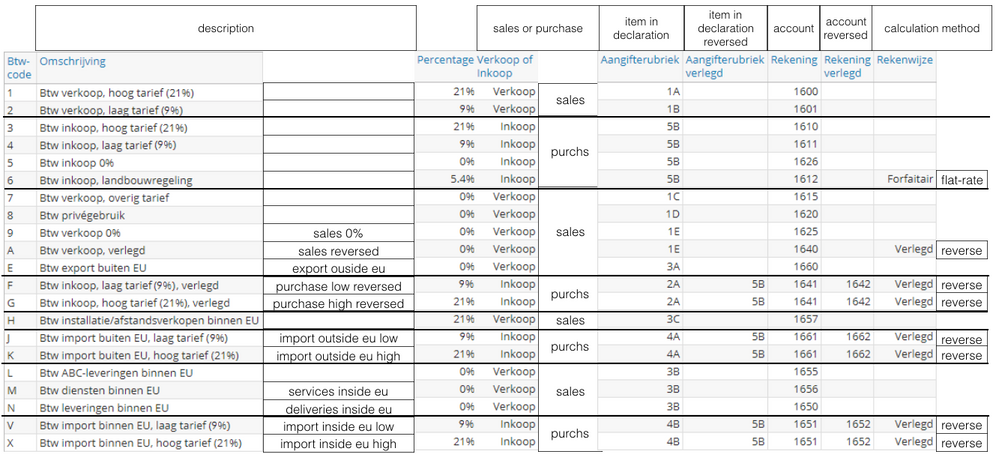

Finally, one bit of information to tie this together: how VAT codes, the generated VAT report, and ledger accounts are connected in Visma. The English documentation on this topic consists of a screenshot, in Dutch, apparently of a settings view that normally isn't available to end users. Perhaps for an accountant, seeing the table alone would be enough, but to make better sense of it myself, I amended it using more or less accurate translations from above:

Here the columns labeled "item in declaration [reversed]" map transaction amounts to the VAT declaration generated by Visma.

So, intracommunity acquisition of services (at the default VAT rate) is filed with VAT code X (21%, purchase, reverse VAT), and the mapping adds the amount to columns 4B and 5B in the VAT declaration, which is correct, since you're supposed to report that amount as "input VAT".

Visma eAccounting BV

HJE Wenckebachweg 200

1096 AS Amsterdam

Tel: 020-355 29 99

Copyright 2021 Visma Community. All right reserved.